Our fees:

$1,000,000 Donation

-$20,000 Credit Card Fees

-$100 Transaction Fees

=$979,900 Donation After Fees

Save $40,000+

in Donations

Additional Plans & Growth Oportunities

Enjoy using Processing on the Free & Basic plans. We have other plans to help give your nonprofit an extra boost.

Free Plan

FREE

2.75% + 25¢

per successful card charge

KEY FEATURES:

- 2.75% + 25¢ per transaction

- Access to free nonprofit tools

Plus Plan

$500/mo

2.33% + 25¢

per successful card charge

KEY FEATURES:

- 2.33% + 25¢ per transaction

- Access to a set of nonprofit tools focused on fundraising, visibility or operations

Pro Plan

$750/mo

2.10% + 15¢

per successful card charge

KEY FEATURES:

- 2.10% +15¢ per transaction

- Access to a complete suite of nonprofit tools

| Comparison Chart |

|

|

|

|

| Processing Fees | 2.10% + 15¢ per transaction | 2.6% + 10¢ per transaction | 2.9% + 30¢ per transaction | 2.9% + 30¢ per transaction |

| ACH Processing Fees | 50¢ per transaction | 1% with a $1 minimum per transaction | NA | 2.9% + 30¢ per transaction |

| Money Availability | 3-5 Days | 1-2 Days | Weekly | 3-5 Days |

| Payment Methods | All major credit cards, ACH | All major credit cards, Apple Pay & Google Pay, ACH | All major credit cards | PayPal Payments, PayPal Credit, and all major credit and debit cards, ACH |

| Sign-up Time | 2-5 minutes | 2-5 minutes | 2-5 minutes | 2-5 minutes |

| Accept Online/In-Person Payments |

|

|

|

|

| Connect Existing Account to PWI Processing |

|

|

|

|

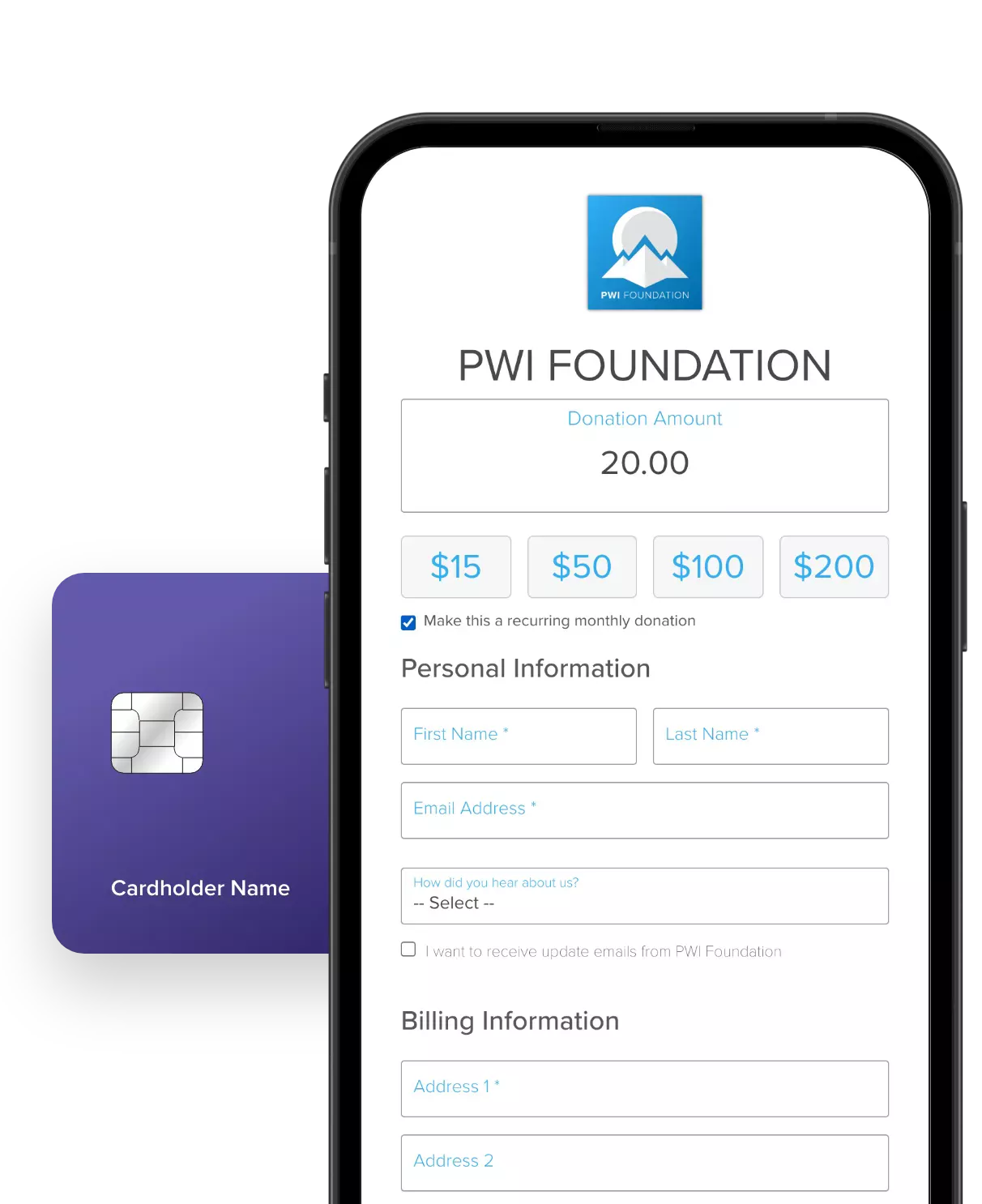

| Scheduled Payments |

|

|

|

|

| Card Swiping |

|

|

|

|

| Convenience Fees |

|

|

|

|

See What Our Users Are Saying About Search